IFSC Code for bank is a eleven digits unique number which has a combination of alphabets and numeric. Using ifsc code branch checker is the easy way to get all information of any bank. Indian Financial System Code or IFSC is allotted by RBI (Reserve Bank of India) to all banks and its branches in India. In this guide, you’ll learn How to find IFSC Code for banks in India 2024.

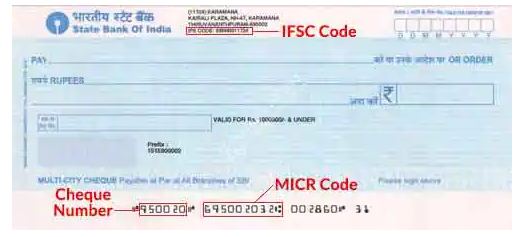

Generally, the IFSC code of a bank can be found on your bank account passbook, cheque book or check leaf issued by the bank. To perform a complete fund transfer, you must need a valid IFSC code. All types of fund transfers like NEFT, IMPS and RTGS need IFSC code to complete the process.

IFSC Full Form & What is IFSC Code for Bank?

The full form of IFSC is “Indian Financial System Code“.

The IFSC Code is an 11 digit alpha-numeric code that is used to uniquely find bank branches within the National Electronic Funds Transfer (NEFT) network by the central bank.

IFSC code is used when we do electronic payment system applications such as NEFT, RTGS (Real-time Gross Settlement) and CFMS (Centralized Funds Management Systems). You cannot perform fund transfer from one bank to another without IFSC. Every bank branch has a unique code and never shares two or more branches with a single IFSC code (even the same bank).

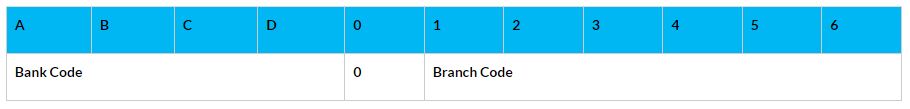

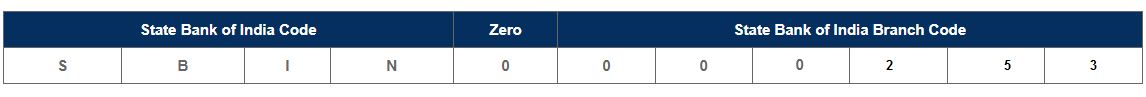

In an IFSC Code, the first 4 digits represent the bank, the last 6 digits mean the branch and the 5th digit of IFSC code is zero.

For example, below is the IFSC code of SBI Tallakulam, Madurai.

SBIN0000253 – The first four letters “SBIN” is bank and the last 6 digits 000253 is branch.

How to Use IFSC Code Branch Checker?

There are several ways to find the IFSC code of a bank. Those are,

- IFSC code can be found on the bank passbook and cheque leaf provided by the respective banks.

- You may obtain all bank IFSC codes from the Reserve Bank of India’s website.

- The IFSC code of any bank can be found on the respective bank’s official website.

IFSC Code Benefits.

The benefits of IFSC code are:

- IFSC code helps to identify a bank and its all respective branches.

- Helps to eliminate errors during the process of fund transfer.

- Fund transfers done using IFSC like IMPS, NEFT and RTGS.

IFSC Code for Government Banks in India 2024

Punjab National Bank (With Merger of Oriental Bank of Commerce and United Bank of India)

Bank of Baroda (With Merger of Dena Bank & Vijaya Bank)

Canara Bank (With Merger of Syndicate Bank)

Union Bank of India (With Merger of Andhra Bank and Corporation Bank)

Indian Bank (With Merger of Allahabad Bank)

IFSC Code of Private Sector Banks in India 2024

Tamilnad Mercantile Bank Limited

Also read Best banks in India and Branches, ATMs all other details about Indian Public Sector Banks and Private Sector Banks n India.

What is MICR Full Form?

The full form of MICR is “Magnetic Ink Character Recognition” technology. It’s a code printed on cheques. This helps to identify the cheques and do the fast processing.

An MICR code in banking is a 9 digits code which helps uniquely identify the bank and its branch name during participating in ECS (Electronic Clearing System).

The MICR comprises into 3 parts:

- The first 3 digits represent the city (City Code, ie, PIN code we use for postal addresses in India.

- Next 3 digits represent the bank (Bank Code).

- The last 3 digits represent the Branch Code.

What are the benefits of MICR Codes?

The MICR code enables perfect, efficient and fast and error free processing of cheques. This could be done perfectly with magnetic ink, reading machines and technology.

Details of Fund Transfers Using IFSC

|

Transaction Charges |

|||

| Amount | NEFT | RTGS | IMPS |

| Up to Rs. 10,000 | Rs. 2.50 | Min. 2 Lakhs | Rs. 5.00 |

| Rs 10,000 – 2 Lakh | Rs. 15.00 | Rs. 26 | Rs. 10.00 |

| Above 2 Lakh | Rs 25.00 | Rs. 51 | Rs. 15.00 |

Each bank has its own charges for transactions within these limits. You may check the transaction charges from the respective bank’s website.

- NEFT – 8 A.M to 7 P.M (Weekdays)

- RTGS – 9 AM to 4:30 P.M (Weekdays)

- IMPS – 24 X 7 (365 days)

How to Transfer Money using IFSC Code?

Using IFSC code is the best way to transfer money quickly, easily and hassle-free. Using the IFSC codes assigned by the Reserve Bank of India (RBI) for each bank will help you to do the transfer safely and quickly. You can transfer the fund through NEFT, IMPS and RTGS using a valid IFSC code.

Let’s see how IFSC code works during the fund transfer.

For instance, the IFSC code of SBI Bank, Tallakulam Madurai branch is SBIN0000253.

Easy steps to transfer money using IFSC code:

SBIN0000253

- The first 4 digits of IFSC code identify the bank. In our case it’s SBIN – State bank of India.

- The 5th digit is always 0 (zero).

- The last 6 characters of IFSC code 000253, helps to identify the particular branch of the bank. (Here it’s Tallakulam, Madurai – TamilNadu).

When a payer initiates a fund transfer through NEFT, RTGS or IMPS, he or she has to give the bank details like account holder name, account number, branch and the IFSC code of the payee.

Once the payer provided all mentioned details above, the fund will be transferred to the account of the payee using IFSC code quickly and error free. Also, the fund transfer with IFSC is more secure, convenient and you can transfer quickly.

IFSC Fund Transfer through SMS:

Using digital technologies, you can easily transfer funds via SMS from a mobile phone using IFSC code. Below is the simple step-by-step process to use IFSC code to transfer money.

In order to transfer money from your mobile, you need to link your mobile number with your bank account. You can easily link your account number with mobile through mobile banking services.

To register your mobile with mobile banking, you need to fill a form to request mobile banking services. You’ll get a unique 7 digit number which is known as mPin and MMID.

Once your mobile banking is activated, you need to create an SMS and type IMPS with payee details.

You need to provide the payee name, bank name, branch, account number and IFSC code of the payee bank with the sum amount you would like to transfer using mobile SMS.

Once you’ve confirmed the transaction through SMS, you’ll get a confirmation message to provide your mPin.

Provide the mPin and click on OK and now the fund will be transferred to the Payee without any issues.

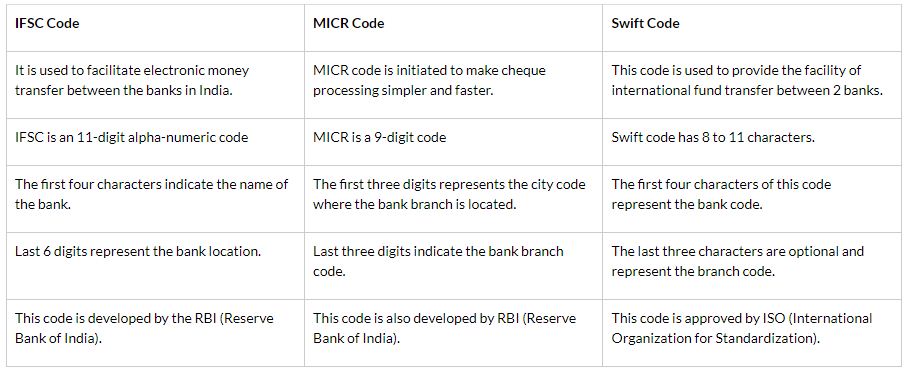

Major Difference Between IFSC Code, MICR Code & SWIFT Code

To make the online transaction faster, all banks and financial institutions are using certain codes. These codes are called IFSC, MICR and Swift code. Each code plays a significant role in terms of fund transfers and quick transactions. Here is the difference between these codes.

IFSC Code for Canara Bank

Canara bank management has informed its customers that the IFSC codes of “Syndicate Bank will be disabled on 1st July 2021”. The Syndicate Bank customers have to update their banks branch’s IFSC code before 30 June 2021.

Why are IFSC codes changing in Canara Bank?

As part of massive bank merging, Finance Minister “Nirmala Sitharaman” had announced the merger of 10 public sector banks into 4 mega state owned ones in 2019. As the bank merger came into effect on April 2020, the IFSC and MICR codes are getting updated from 2024 financial year (i.e. from 1, April 2021).

However, you may need to contact the bank prior to request to update IFSC code and MICR.

Conclusion

Thanks for reading IFSC codes for all banks. Please share this guide.

Leave a Reply